What is EITC?

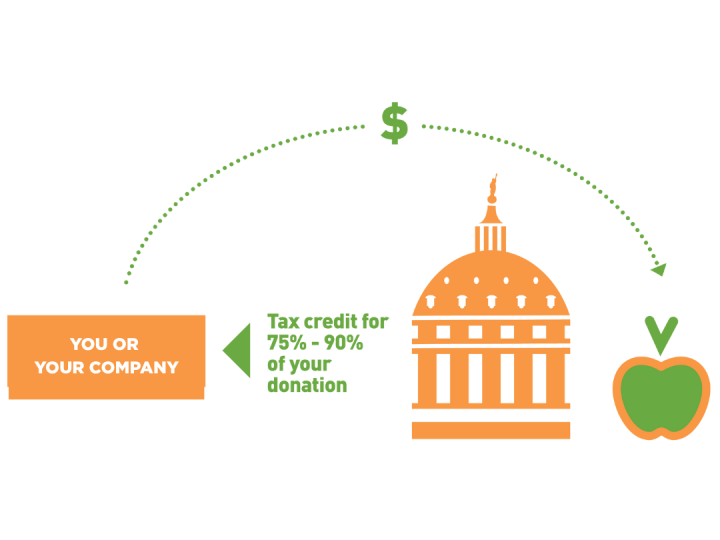

The Pennsylvania Educational Improvement Tax Credit (EITC) program allows individuals, couples, and businesses to receive significant tax credits in exchange for donations to approved educational organizations (EIOs) like Vetri Community Partnership.

These contributions directly support Vetri Community Partnership’s school-based nutrition education programs including Vetri Cooking Lab and Culinary Classroom.

For individuals, couples, and non-approved businesses, Vetri Community Partnership partners with Friends of Education, a Special Purpose Entity, to help you maximize your charitable impact through the Pennsylvania EITC program.

You may be eligible for a tax credit from EITC if:

- You file taxes jointly with your spouse who owns shares of or is employed by a business with physical presence in Pennsylvania.

- You are employed by a business with physical presence in Pennsylvania.

- You own one or more shares in a business with physical presence in Pennsylvania.

Businesses housed in Pennsylvania that pay taxes are eligible to apply for approved status with the Commonwealth. Click here to learn more about the EITC application and approval process.

Can individuals or couples participate?

Yes, here's how!

Individuals, couples and businesses can receive a Pennsylvania state tax credit up to 90% of their tax liability from EITC by contributing through our fundraising partner, Friends of Education LLC.

1. Determine Eligibility: Contact your tax specialist to discuss your eligibility and tax liability.

2. Notify: Let us know that you intend to make an EITC gift. You can contact Christin Kwasny, Director of Development, at christin@vetricommunity.org.

3. Joinder Agreement: Send an email to info@pataxcredits.org to complete a joinder agreement for your contributions.

4. Benefits: Once your donation is processed, you'll receive a K-1 which reflects your contribution and state tax credit.

It’s that easy—redirect your taxes and make a lasting impact on Philadelphia students!

Click here to learn more and for FAQs@vetricommunity

Follow us on social media for recipes, resources and the latest VCP news!

Follow us on Instagram