What is the Educational Improvement Tax Credit (EITC) program?

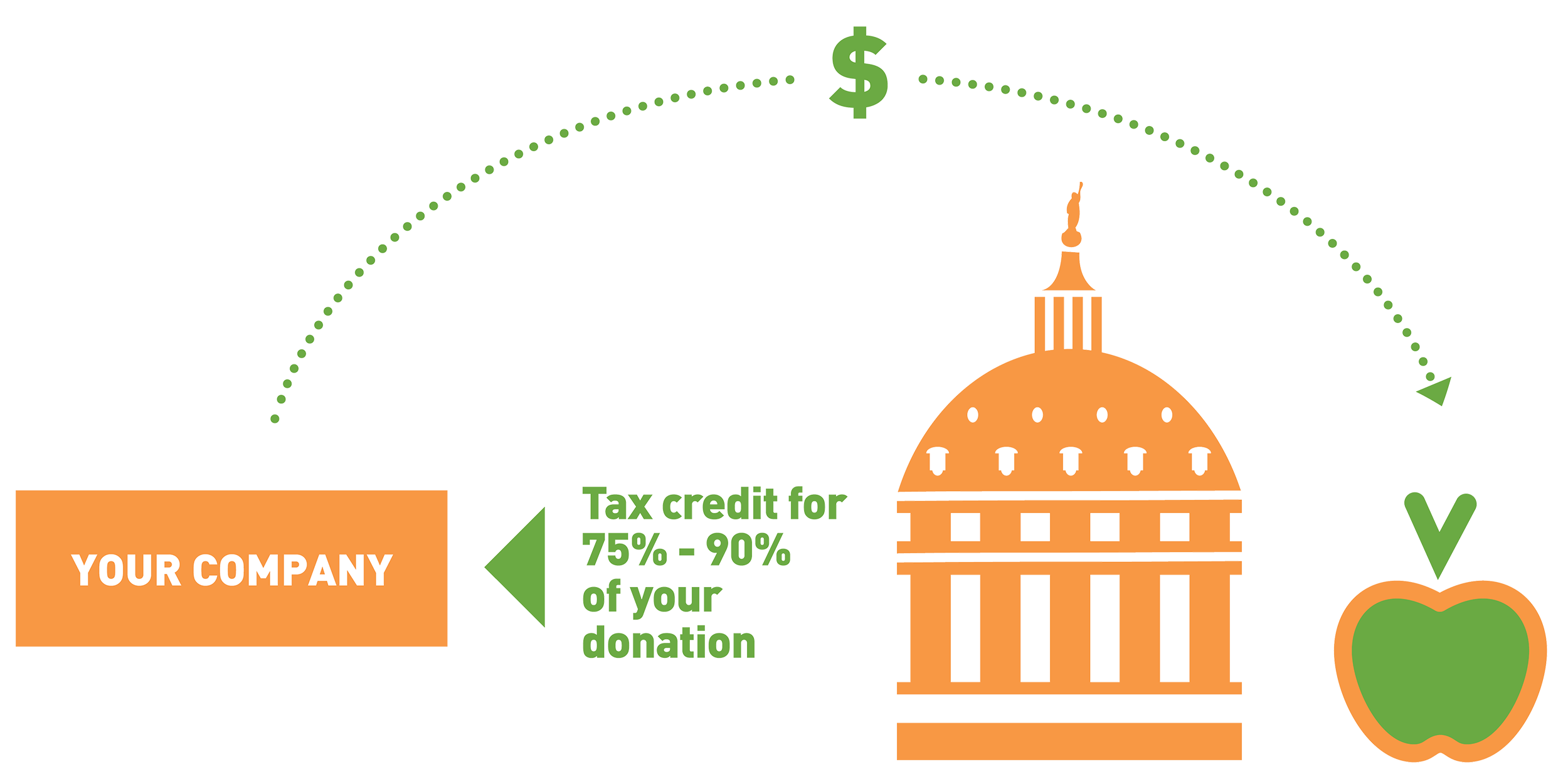

This program was created to provide an incentive for charitable giving by Pennsylvania businesses. Your charitable contribution becomes a low-cost gift when you redirect you state business taxes to the participating Educational Improvement Organization of your choice.

- A one-year commitment will earn you a state tax credit of 75% of your contribution. A business that agrees to provide the same amount for two consecutive tax years will earn a credit of 90%.

- The non-credited portion of the gift can be claimed as a charitable contribution for federal tax purposes.

- Businesses may request up to $750,000 in tax credits per year.

- Any Pennsylvania businesses other than a Sole Proprietorship is eligible.

The credit is available to offset:

- Corporate Net Income Tax

- Capital Stock Franchise Tax

- Bank and Trust Company Shares Tax

- Title Insurance Companies Shares Tax

- Insurance Premiums Tax

- Mutual Thrift Institution Tax

- Insurance Company Law of 1921

- Personal Income Tax of S Corporation Shareholders or Partnership Partners

How does my company apply?

Step 1: Pennsylvania businesses can begin applying for EITC credits through DCED’s electronic single application system.

Step 2: Your business receives a tax credit approval letter from the State.

Step 3: Your business makes its gift to Vetri Community Partnership within 60 days of receiving its tax credit approval letter.

Step 4: Vetri Community Partnership receives the gift, and your business provides proof of the gift to the State within 90 days of receiving the tax credit approval letter.

Step 5: File your business tax returns normally.

For more information on taking advantage of this program, please contact Christin Kwasny, Director of Development, at christin@vetricommunity.org or by calling 267-281-6350.